FRENCKEN GROUP LIMITED

ANNUAL REPORT 2014

08

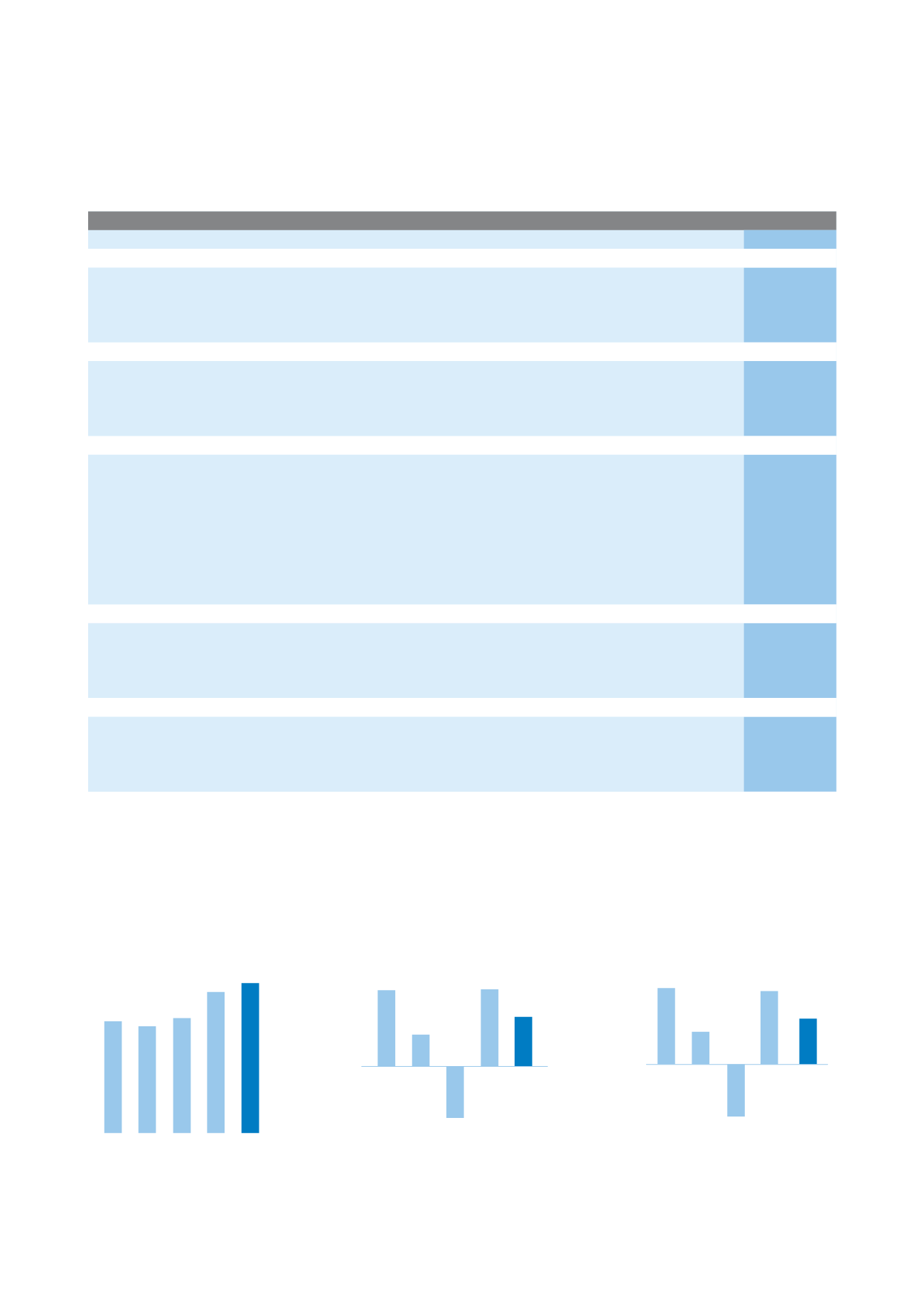

FINANCIAL SUMMARY

(1)

Operating profit represents profit before interest, tax and exceptional items

(2)

This represents the difference between the average market capitalisation and average shareholders’ equity for the year

FINANCIAL YEAR

FY DEC

FY DEC

FY DEC

FY DEC

FY DEC

2010

2011

2012

2013

2014

Operating Results

$'000

$'000

$'000

$'000

$'000

Revenue

351,796

335,547

360,957

444,737

472,737

Operating profit

(1)

22,478

12,091

1,431

24,866

17,806

Profit/(Loss) attributable to equity holders

17,552

7,341

(11,810)

17,744

11,358

Financial Position

$'000

$'000

$'000

$'000

$'000

Total assets

283,640

282,489

355,779

335,095

352,262

Total liabilities

87,350

86,127

167,773

128,030

143,807

Shareholders' equity

196,290

196,362

186,842

205,282

206,916

Key Ratios

Net profit/(loss) on turnover (%)

5.0

2.2

(3.3)

4.0

2.4

Return on average equity (%)

9.0

3.7

(6.2)

9.1

5.5

Net (cash)/debts to equity (%)

(17.1)

(7.6)

20.5

15.4

17.7

Earnings/(Loss) per share - basic (cents)

4.7

2.0

(3.2)

4.5

2.8

- diluted (cents)

4.7

2.0

(3.2)

4.4

2.8

Net assets value per share (cents)

53.6

53.3

47.1

51.5

51.2

Dividend per share (cents)

1.44

0.61

0.50

1.40

1.00

Share Price and Market Capitalisation

Cents

Cents

Cents

Cents

Cents

Highest

35.0

35.0

26.0

28.0

39.0

Lowest

20.5

24.0

18.5

19.1

21.5

Average

26.6

28.5

22.0

22.2

32.0

$'000

$'000

$'000

$'000

$'000

Average market capitalisation

97,345

104,932

87,185

88,415

129,431

Average shareholders' equity

195,789

196,326

191,602

196,062

206,099

Market value differential

(2)

(98,444)

(91,394)

(104,417)

(107,647)

(76,668)

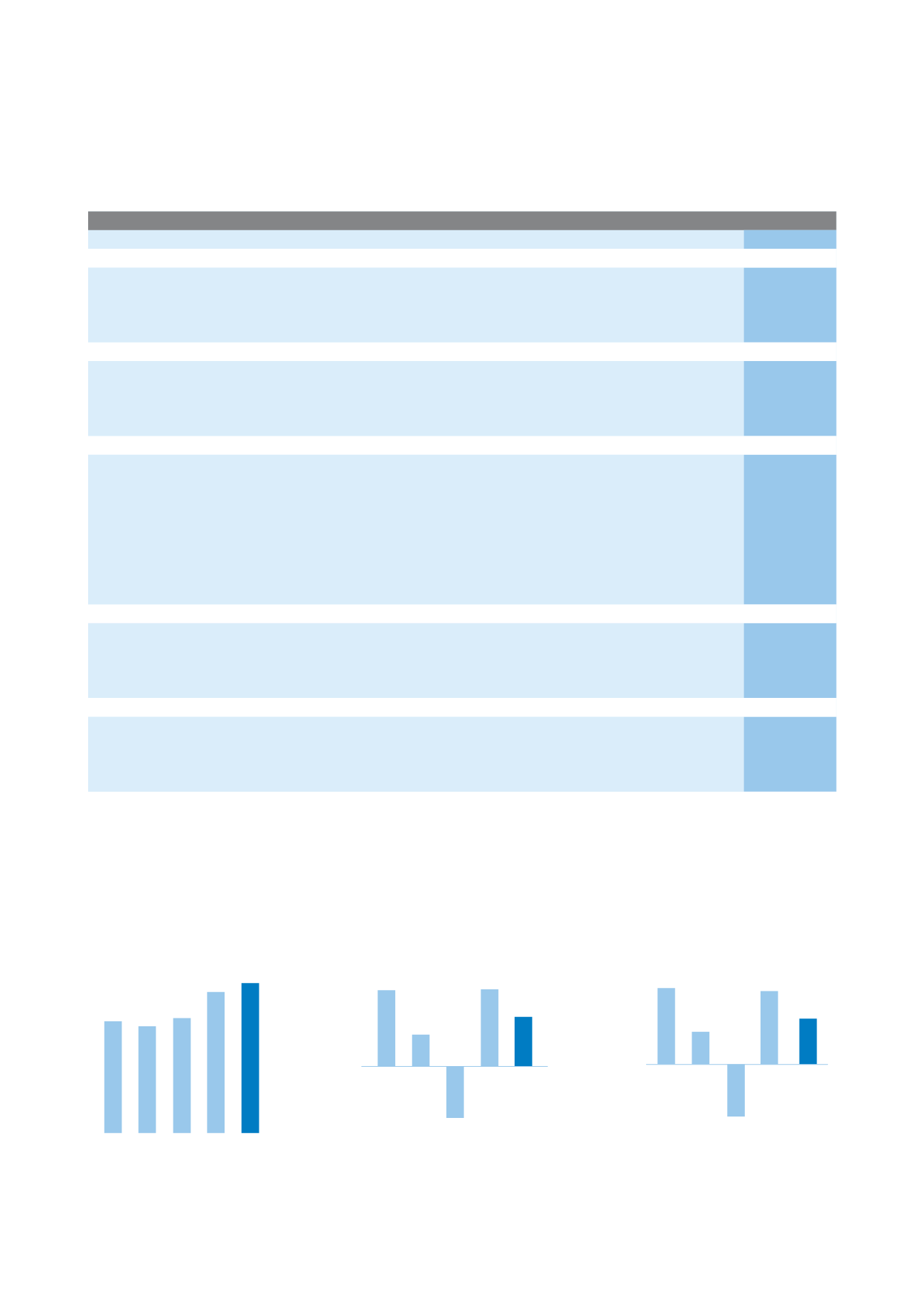

Revenue ($’000)

Profit/(Loss) attributable to

equity holders ($’000)

Earnings/(Loss) per share -

basic (cents)

2010 2011

2013

2012

2014

472,737

351,796

360,957

335,547

444,737

2010 2011

2013

2012

2014

11,358

17,744

17,552

7,341

(11,810)

2010 2011

2013

2012

2014

4.7

(3.2)

2.0

2.8

4.5