09

FRENCKEN GROUP LIMITED

ANNUAL REPORT 2014

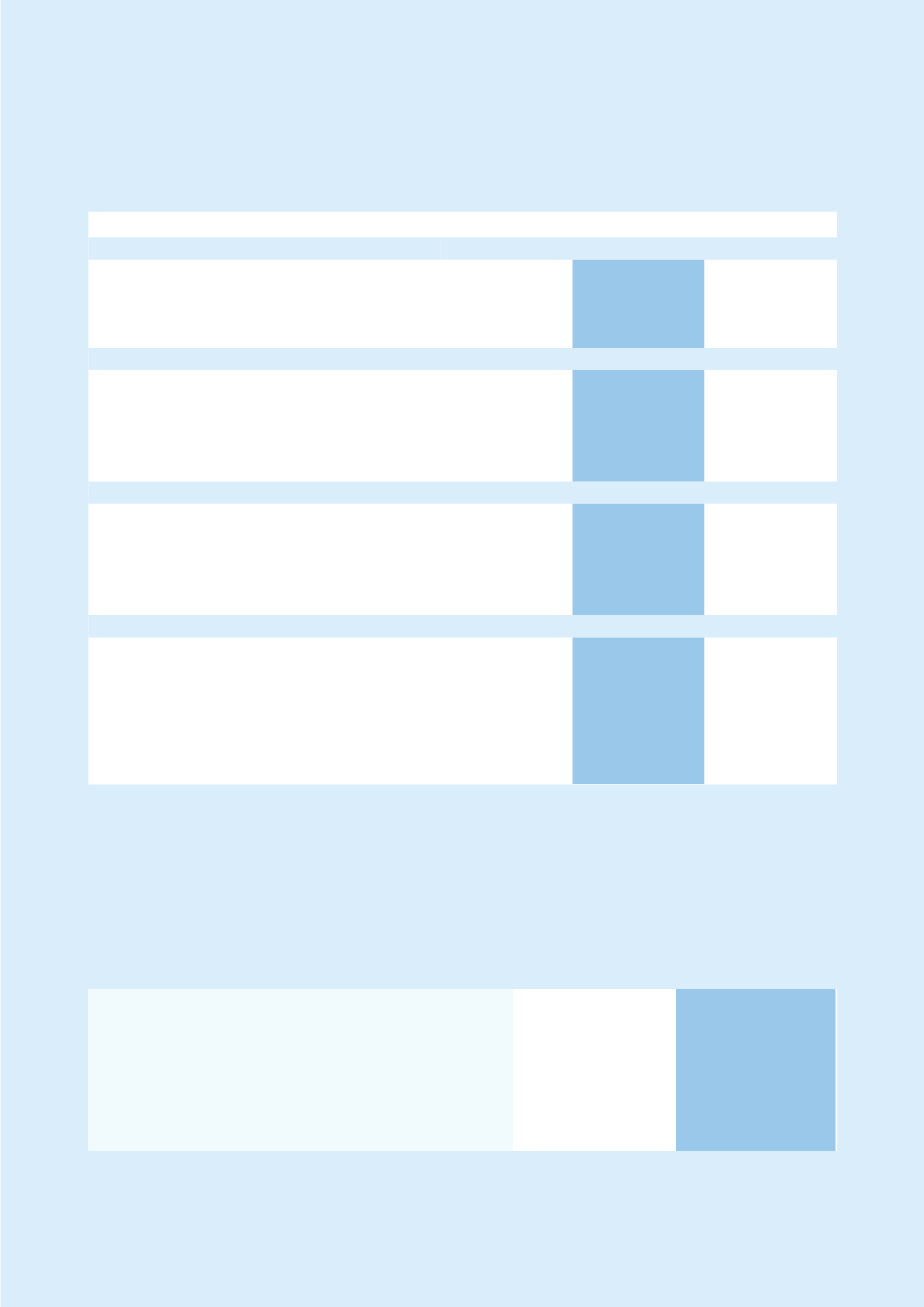

FINANCIAL HIGHLIGHTS

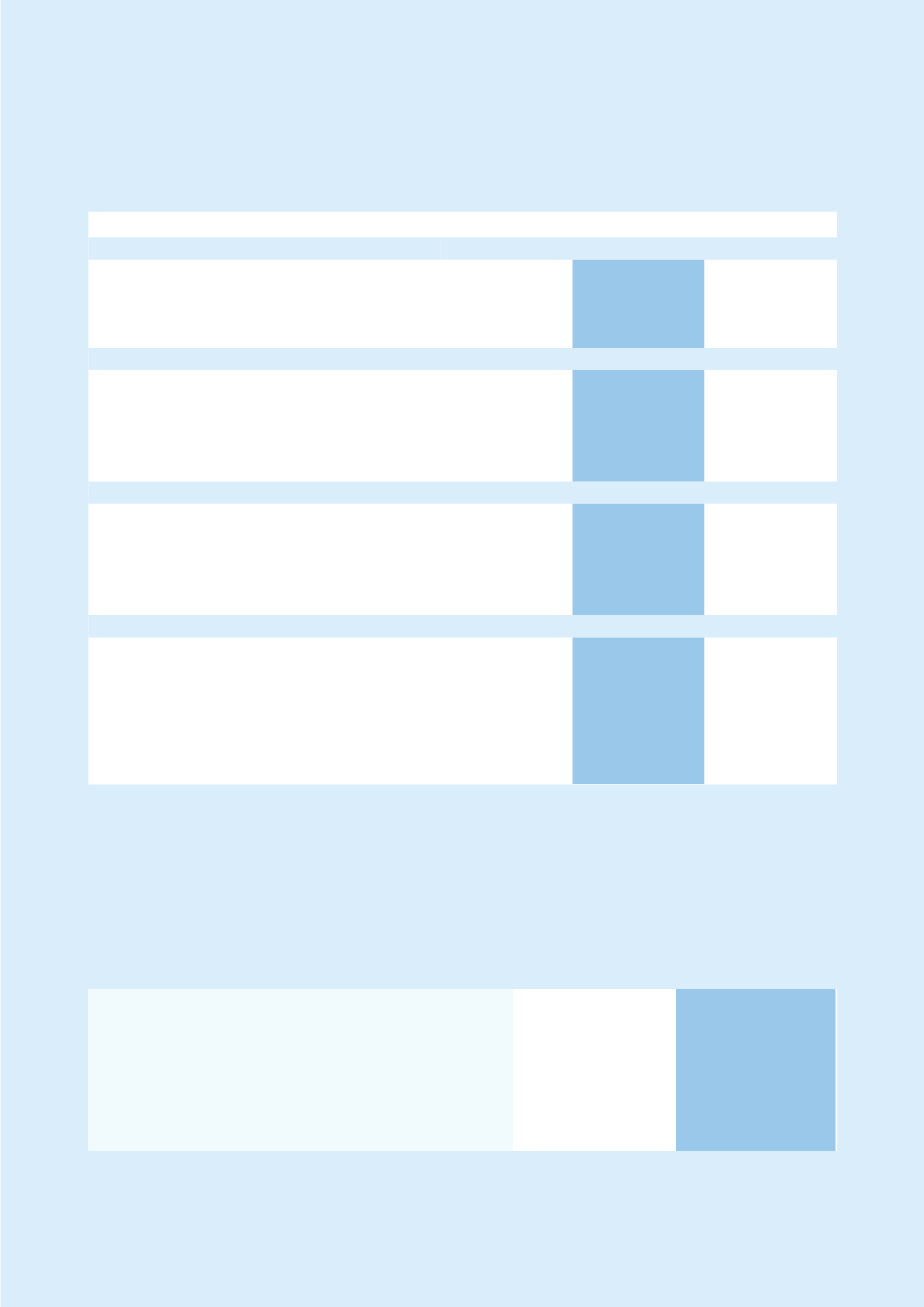

FINANCIAL CALENDAR

(1)

Operating profit represents profit before interest, tax and exceptional items

(2)

Interest cover ratio = Profit before interest on borrowings, tax and exceptional items/interest on borrowings

Financial year

31 December 2014

31 December 2015

Announcement of Results

1

st

Quarter

8 May 2014

7 May 2015

2

nd

Quarter

14 August 2014

6 August 2015

3

rd

Quarter

7 November 2014

5 November 2015

4

th

Quarter

26 February 2015

February 2016

Delivery of Annual Report

8 April 2015

April 2016

Annual General Meeting

23 April 2015

April 2016

2013

2014

Change

1 Operating Results

$'000

$'000

%

Revenue

444,737

472,737

6.3

Profit attributable to equity holders

17,744

11,358

(36.0)

Net profit on turnover (%)

4.0

2.4

(40.0)

2 Divisional Performance

$'000

$'000

%

Mechatronics - Revenue

273,857

299,199

9.3

- Operating profit

(1)

11,152

12,796

14.7

IMS - Revenue

170,861

173,519

1.6

- Operating profit

(1)

13,728

5,092

(62.9)

3 Solvency Profile

$'000

$'000

%

Cash and cash equivalents

19,634

18,770

(4.4)

Borrowings

51,213

55,359

8.1

Net debts

31,579

36,589

15.9

Interest cover ratio

(2)

11.1

11.4

2.7

4 Shareholders' Value

%

Shareholders' equity ($'000)

205,282

206,916

0.8

Earnings per share - basic (cents)

4.5

2.8

(37.8)

- diluted (cents)

4.4

2.8

(36.4)

Return on average equity (%)

9.1

5.5

(39.6)

Net asset value per share (cents)

51.5

51.2

(0.6)

Dividend payout ratio (%)

31.4

35.6

13.4