11

FRENCKEN GROUP LIMITED

ANNUAL REPORT 2014

BUSINESS REVIEW

(CONT’D)

For FY2014, the Group reported a 36.0%decline in net profit

attributable to equity holders to S$11.4 million, compared

to S$17.7 million in FY2013. This was due mainly to lower

gross profit, recognition of non-cash exceptional charges of

S$0.7 million, and the absence of foreign exchange gain of

S$2.2 million that was recognised for FY2013.

As at 31 December 2014, the Group had shareholders’

equity of S$206.9 million. This is equivalent to net asset

value of 51.2 cents per share, based on the total number of

issued shares of 404.5 million shares.

Total assets as at 31 December 2014 increased to S$352.3

million from S$335.1 million at the end of December

2013, attributed mainly to increases in intangible assets,

inventories, and trade receivables. Intangible assets

increased to S$24.9 million from S$19.7 million as at 31

December 2013, attributable mainly to goodwill arising

from the acquisition of NTZ and development costs incurred

for on-going projects at the Europe operations.

Inventories increased to S$95.7 million from S$85.9 million

at the end of FY2013 for fulfillment of customers’ orders

and higher stock of finished goods held for automotive

customers. Trade receivables increased to S$87.2 million,

from S$83.0 million as at 31 December 2013, due to higher

sales in the fourth quarter of FY2014 as compared to the

same period in FY2013.

Total liabilities increased to S$143.8 million as at 31 December

2014 from S$128.0 million at the end of FY2013, attributable

mainly to increases in trade and other payables, and bank

borrowings. Trade payables increased to S$49.1 million from

S$40.5million as at 31 December 2013, in tandemwith higher

purchases of materials required to fulfill customers’ orders. As

at 31 December 2014, the Group had net bank borrowings

of S$36.6 million, compared to S$31.6 million at the end of

FY2013. Accordingly, the Group’s net debt-to-equity ratio

increased to 17.7% from 15.4% as at 31 December 2013.

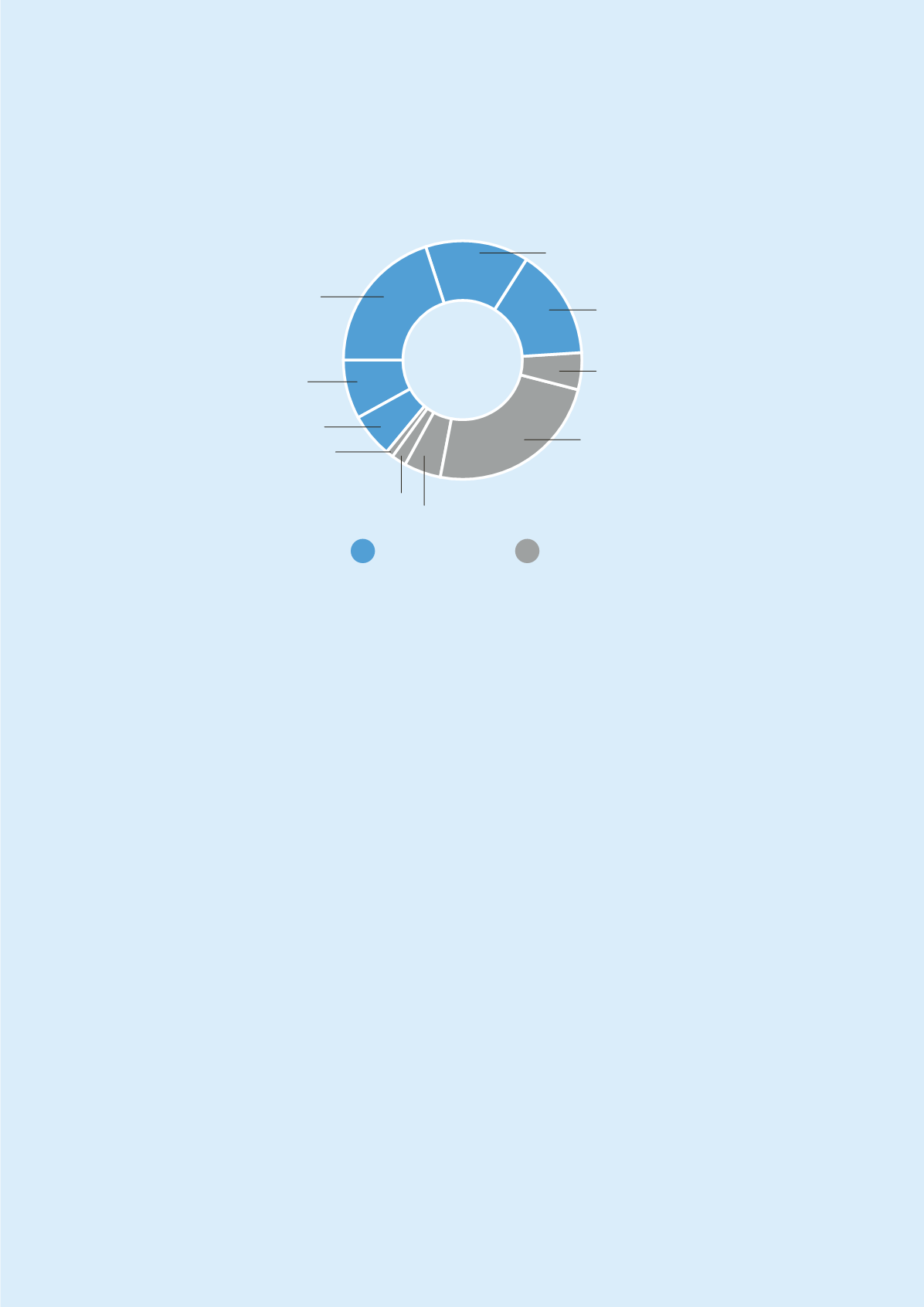

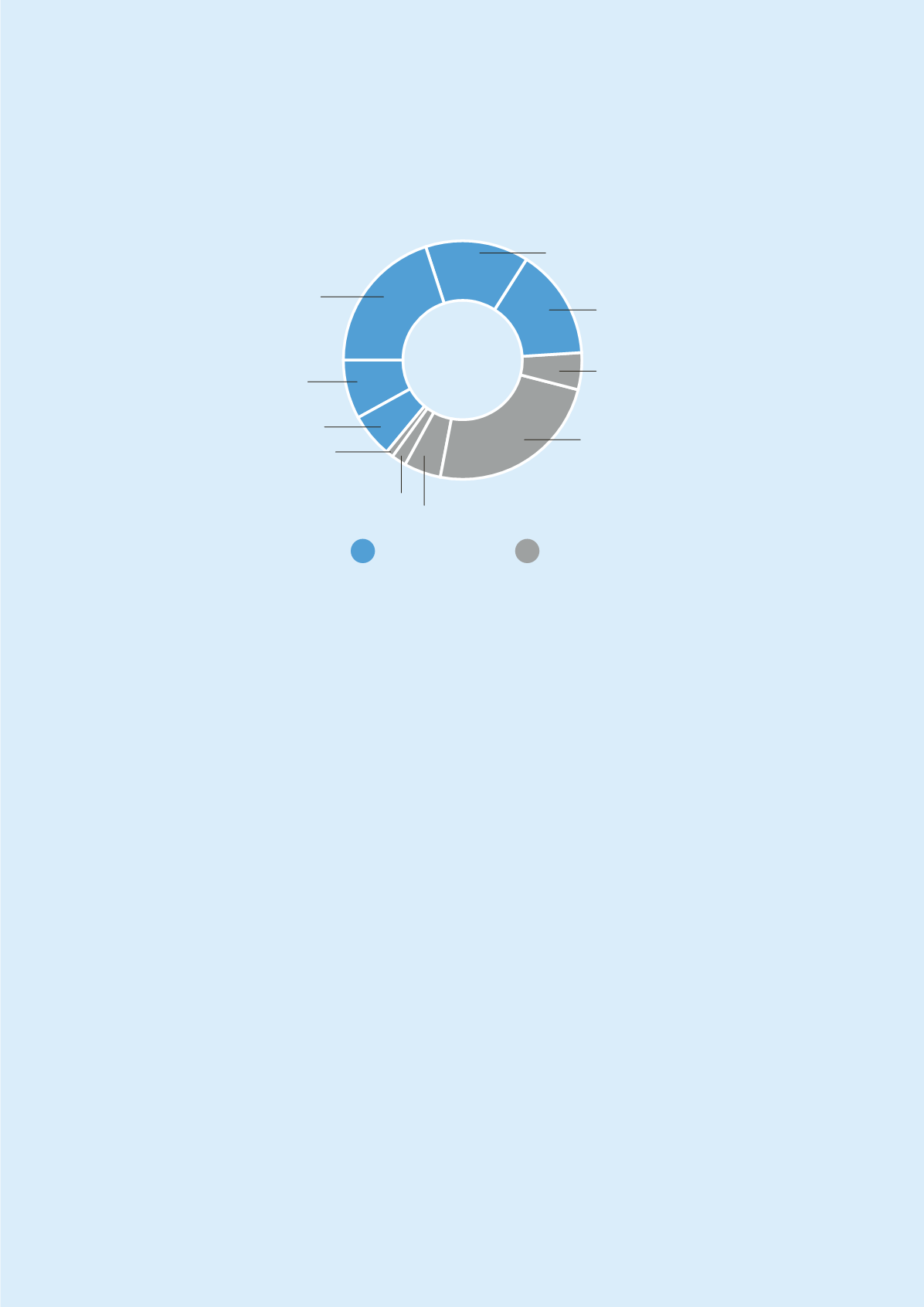

Revenue breakdown by business segment

Mechatronics

IMS

Analytical (20%)

Semiconductor (15%)

Office Automation (5%)

Others (1%)

Automotive (24%)

Industrial Automation (8%)

Medical (14%)

Tooling (2%)

Consumer & Industrial Electronics (5%)

Others (6%)