05

FRENCKEN GROUP LIMITED

ANNUAL REPORT 2014

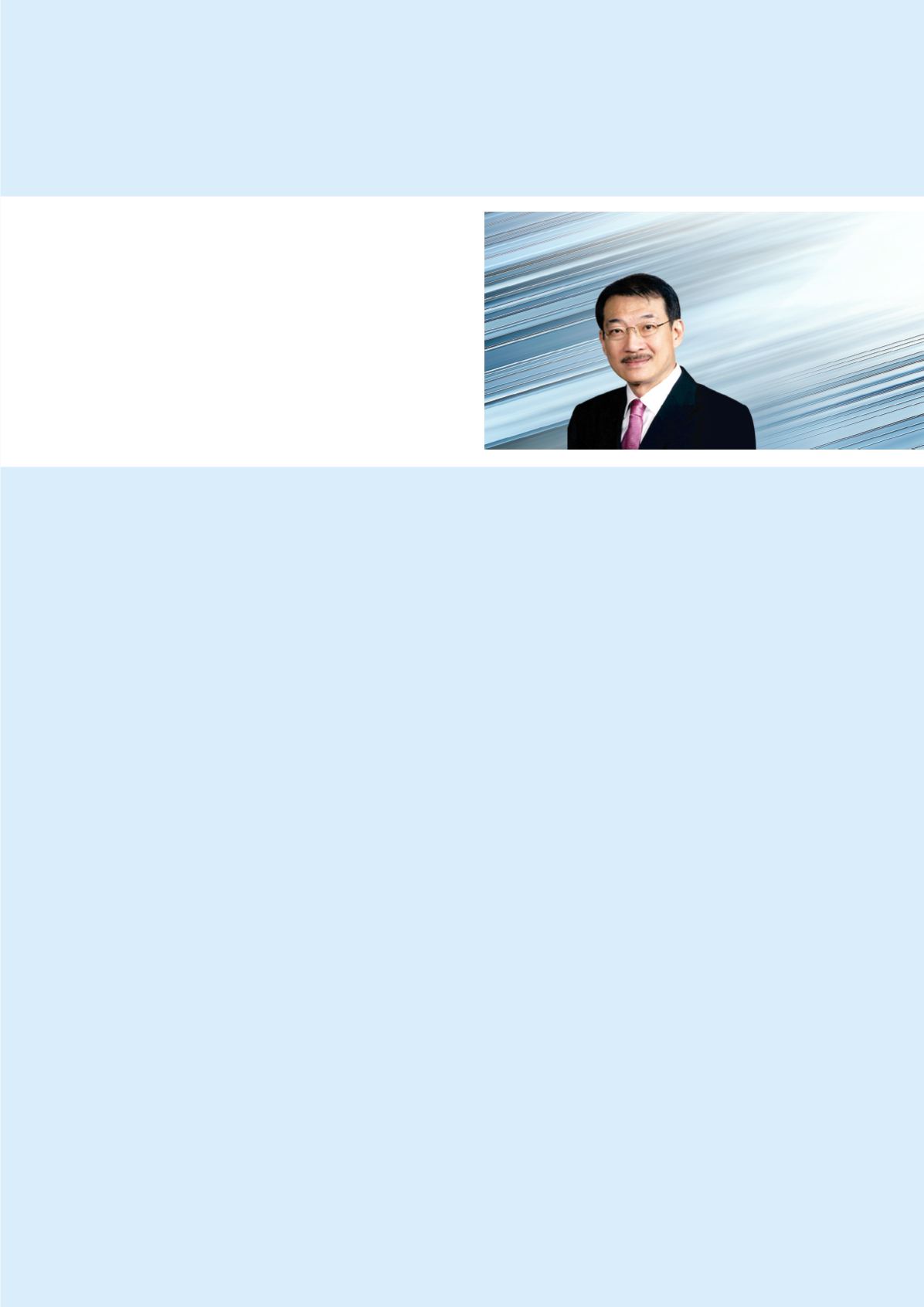

CHAIRMAN’S STATEMENT

It proved to be a challenging year for the Group and one

that we will remember with immense sadness due to the

demise of Mr Gooi Soon Hock, our Executive Director and

President, on 30 December 2014. Being his fellow co-

founder of our Group, Mr Gooi was not only my long-time

business partner but also a close and dear friend.

An extraordinary entrepreneur with integrity, passion and

vision, Mr Gooi was a man who commanded great respect

in the manufacturing sector. In spite of his demanding work

schedule, he was always able to draw a fine line between

his business and private lives. Mr Gooi’s devotion to his

family was inspiring while his determination to honour

business commitments was highly exemplary.

Over the past 35 years, Mr Gooi succeeded in overcoming

many challenges in his drive to build the Group and bring it

onto the global stage. He had envisioned an exciting future

for Frencken but sadly, he was not able to see his dream

coming to fulfilment. With this in mind, I wish to call on

everyone in Frencken to honour Mr Gooi’s legacy and work

together towards turning his vision into reality.

Headwinds in FY2014

In terms of the Group’s operating and financial performance,

FY2014 turned out to be a year of two starkly contrasting

halves. Despite the cautious business sentiment at the

start of the year, the Group still managed to deliver a

commendable set of results for the first half of FY2014 with

higher sales and double-digit growth in net profit.

However, the deteriorating macroeconomic environment,

coupled with softer gross profit margin, higher exceptional

charges, foreign exchange loss and challenging operational

conditions at our Penang plant, adversely affected the

Group’s profitability during the second half of the year. As

a result the Group’s revenue grew 6.3% to S$472.7 million

in FY2014 but net profit attributable to equity holders

declined by 36.0% to S$11.4 million.

Nonetheless, the Group remains in a sound financial position. At

the end of FY2014, the Group had cash and cash equivalents

of S$18.8 million while net bank borrowings stood at S$36.6

million. Shareholders’ equity amounted to S$206.9 million,

which is equivalent to a net asset value of 51.2 cents per share

based on the total number of issued shares of 404.5 million

shares. Accordingly, the Group had a net debt-to-equity ratio of

17.7% as at 31 December 2014.

Since listing on the SGX-ST in 2005, the Group has consistently

paid an annual dividend of at least 30%of net profit attributable

to equity holders. Despite the Group’s softer performance in

FY2014, the Board of Directors has recommended to pay a first

and final tax-exempt (one-tier) dividend of 1.0 cent per share,

which translates into a higher pay-out ratio of 35.6%. Upon

approval by shareholders at the forthcoming Annual General

Meeting on 23 April 2015, the dividend will be paid on 15 May

2015.

Dear Shareholders

On behalf of the Board of Directors,

I present to you Frencken Group

Limited’s annual report for the 12

months ended 31 December 2014

(“FY2014”).