13

FRENCKEN GROUP LIMITED

ANNUAL REPORT 2014

BUSINESS REVIEW

(CONT’D)

Operational Initiatives

During FY2014, the Mechatronics Division continued to work

on several initiatives to enhance its production capacity and

capabilities, expand its customer base and elevate its position

in the value chain.

As part of the division’s plans to strengthen its businessmodel,

the Europe operations has been working on the development

of Original Design Manufacturer (ODM) products for the

medical segment by leveraging the proprietary knowledge

that it has accumulated over the years.

During FY2014, the Europe operations also completed the

extension of a manufacturing facility. It is currently planning

to invest in a new advanced vacuum cleaning facility to offer

industry leading cleaning capabilities and anticipate for future

business volumes.

With established plants located in Southeast Asia and Wuxi

(China), the Asia operations continues to make encouraging

inroads into the region’s markets. During FY2014, it

successfully secured new production orders to manufacture

a wider range of critical components and modules for both

new and existing customers. These new orders include

storage tester automation systems, medical, electronic

assembly, semiconductor packaging, test and handling

modules and systems.

As a testament of its commitment to high quality standards,

the Asia operations was conferred the Best Supplier

Award 2014 by a leading semiconductor assembly and

packaging equipment player. To further raise the standards

of technology, capability and productivity of its operations,

the Mechatronics Division will continue to invest in new

equipment for its production facilities in Europe, the USA

and Asia.

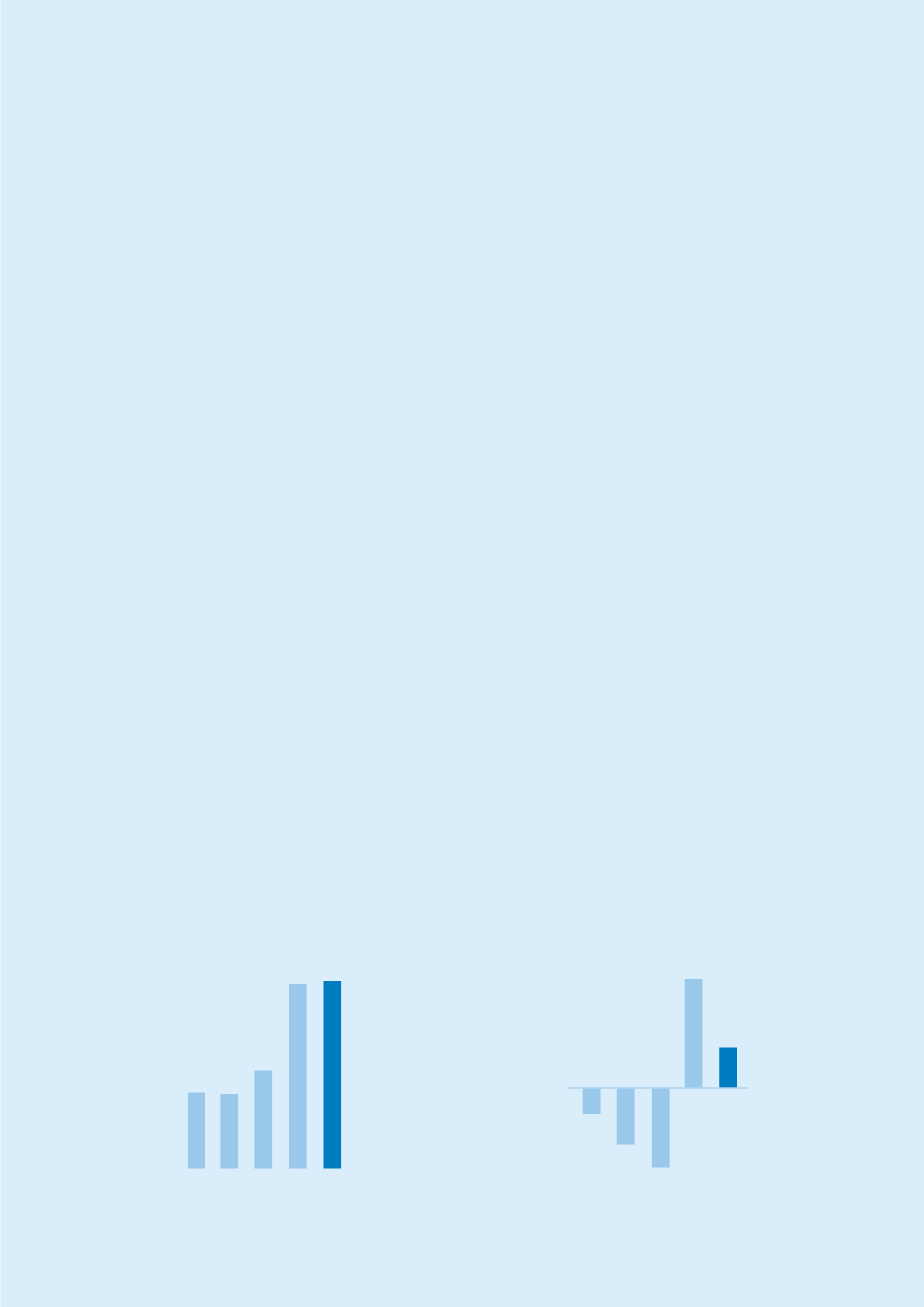

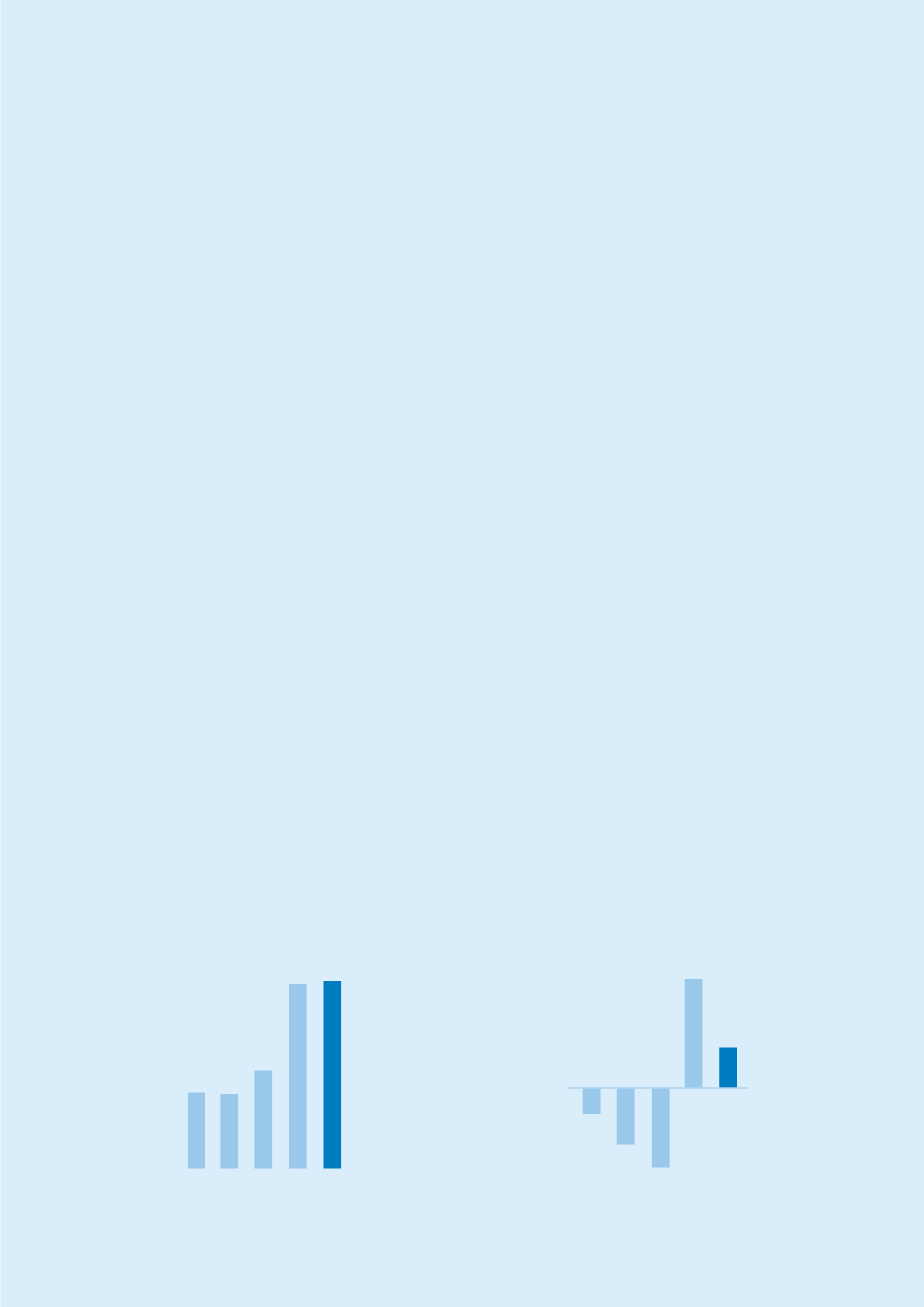

IMS DIVISION’S PERFORMANCE (FY2010 - FY2014)

Note : FY2012 figures include 3 months (Oct to Dec 2012) of post acquisition revenue and operating profit of Juken group of companies.

Revenue ($’000)

2010 2011

2013

2012

2014

70,113

90,454

69,130

170,861

173,519

Operating Profit/(Loss) ($’000)

(3,316)

2010 2011

2013

2012

2014

13,728

(7,280)

(10,180)

5,092

IMS Division

Business segment review

The IMS Division reported a marginal increase in revenue to

S$173.5 million in FY2014, from S$170.9 million in FY2013.

Higher sales of the automotive segment were partially

offset by declines in revenue from the office automation,

consumer & industrial electronics, and tooling segments.

Revenue from the automotive segment increased 14.4% to

S$113.0 million in FY2014 from S$98.8 million previously,

attributable primarily to the inclusion of revenue contribution

from NTZ. This segment witnessed a moderation in growth

during the second half of FY2014 due to the slowdown in

Europe and China economies. Nonetheless, the automotive

segment increased its contribution to 65.1%of the division’s

revenue in FY2014, from 57.8% in FY2013.

The office automation segment registered sales of S$23.2

million in FY2014, a decrease of 21.5% from S$29.6 million

previously, in line with the Group’s decision to progressively

wind down this business segment at the Penang plant. Sales

of the consumer & industrial electronics segment declined

14.3% to S$22.5 million from S$26.3 million in FY2013,

attributable primarily to lower sales of camera components

in Thailand. Due to lower sales of these two product

segments, tooling sales fell correspondingly by 13.8% to

S$12.4 million. The office automation and consumer &

industrial electronics and tooling segments accounted for

13.4%, 13.0% and 7.1% respectively of the IMS Division’s

revenue in FY2014.

In FY2014, the IMS Division’s net profit declined to S$2.7

million from S$9.7 million in FY2013. This is attributed

mainly to softer GP margin, higher operating costs,

foreign exchange loss (versus a foreign exchange gain

previously) and increased transport and freight costs to

expedite customer shipments.