FRENCKEN GROUP LIMITED

ANNUAL REPORT 2015

97

NOTES TO FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2015 (CONT’D)

25 DEFERRED GAIN

In the financial year 2010, one of the subsidiaries of the Company sold its leasehold land and buildings, 1 and 2

Changi North Street 2 Singapore to RBC Dexia Trust Services Singapore Limited (in its capacity as trustee of Cambridge

Industrial Trust) and under the terms of sale and purchase agreement, leaseback the properties for the next 7 years

from the date of the sale on 19 October 2010 to 18 October 2017. The excess of the net sale price of $21,742,000

above the fair value of $14,300,000 which amounted to $7,442,000 was deferred and amortised over the leaseback

period of 7 years, which will be ending on 18 October 2017. The fair value calculation was arrived based on valuation

performed by independent valuer. The deferred gain was presented in the consolidated balance sheet as follows:

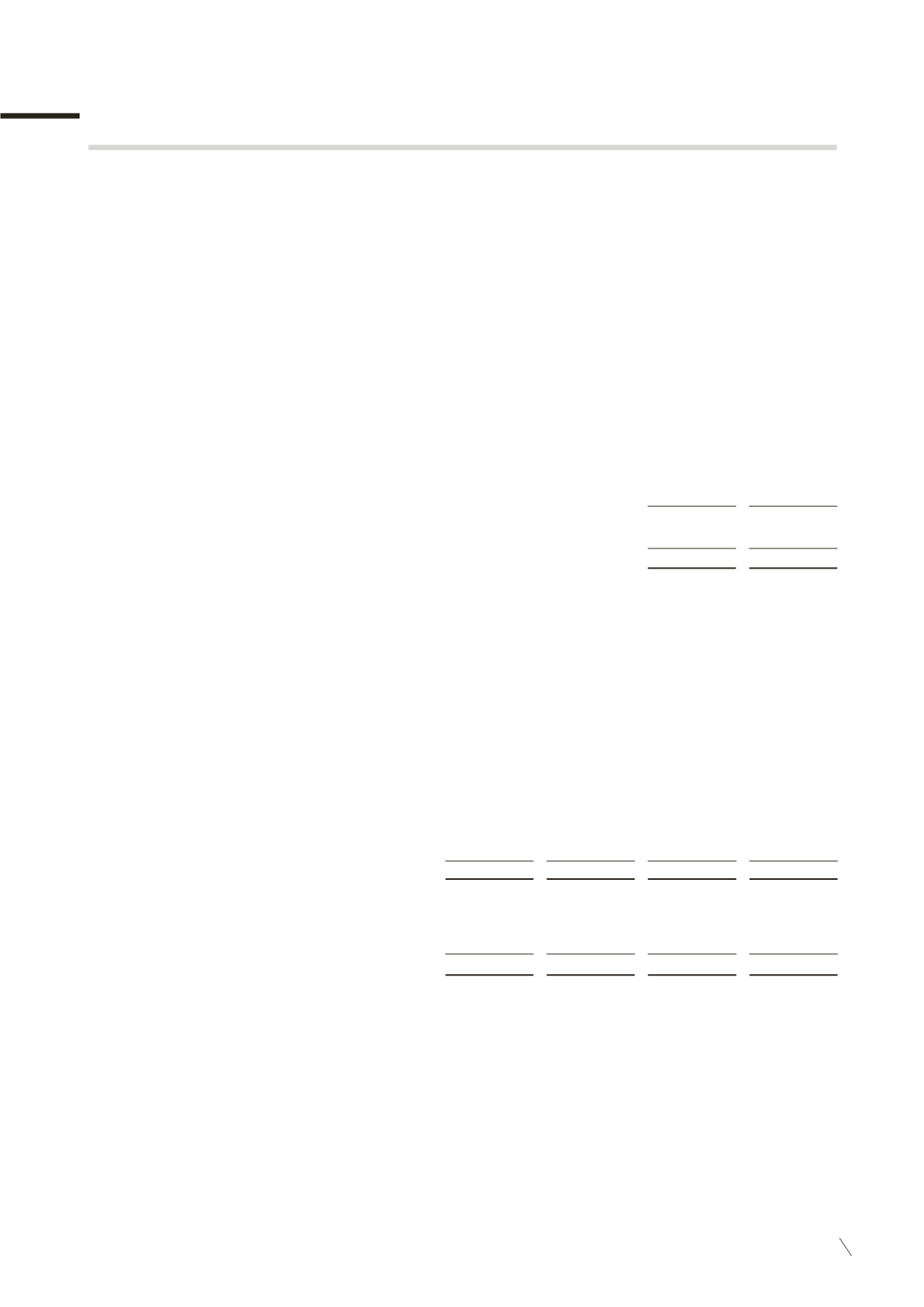

The Group

2015

$’000

2014

$’000

Balance at beginning of financial year

2,923

3,987

Amortisation of deferred gain (Note 6)

(1,063)

(1,064)

Balance at end of financial year

1,860

2,923

Less: Deferred gain (non-current)

(797)

(1,860)

1,063

1,063

26 BORROWINGS

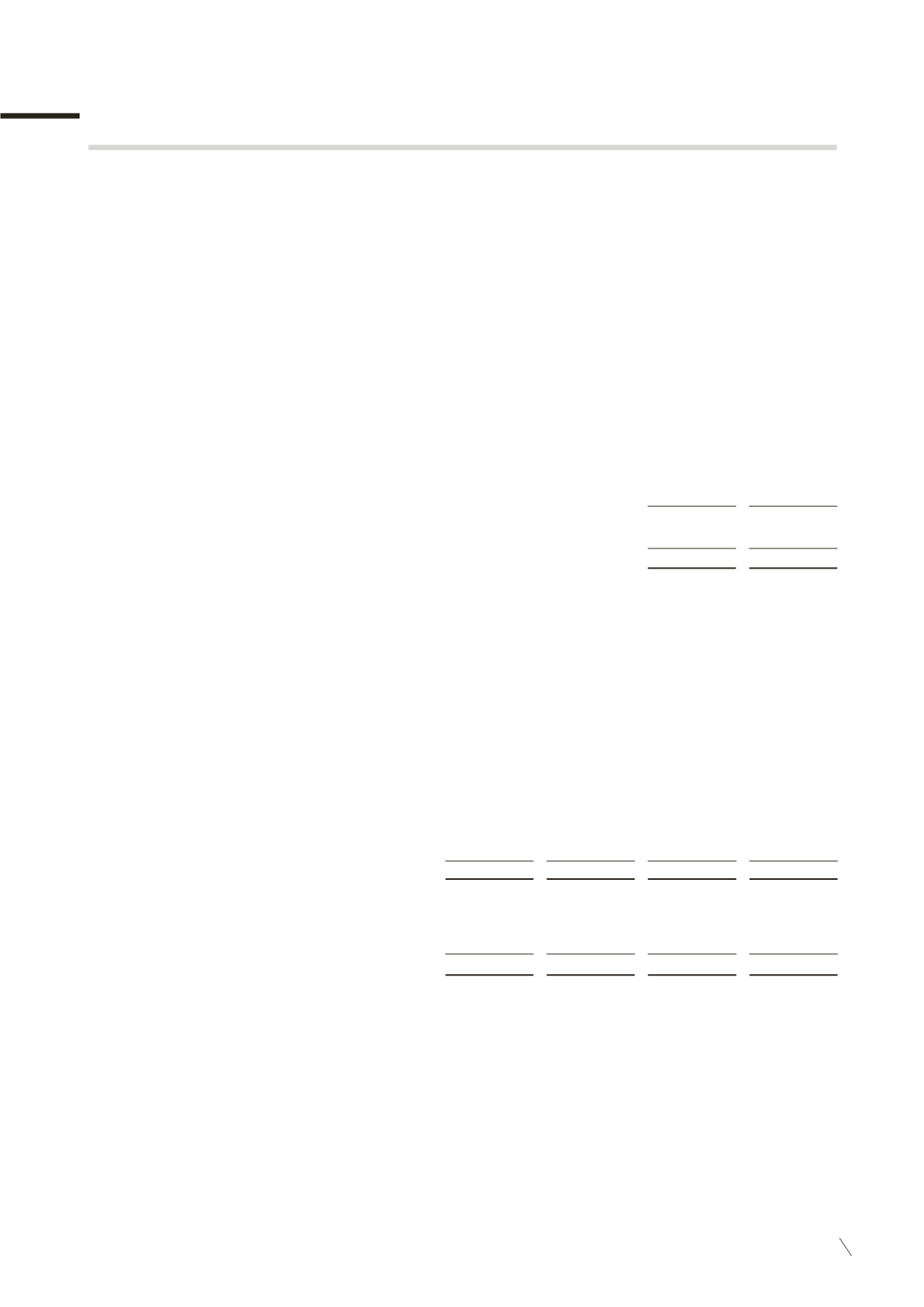

The Group

The Company

2015

$’000

2014

$’000

2015

$’000

2014

$’000

Current

Short term bank borrowings

(1)

:

- Bank overdrafts

26,216

23,534

-

-

- Bankers' acceptances

13,715

10,912

-

-

- Bills payables

4,527

8,304

-

-

- Revolving credits

4,422

8,424

-

400

Finance lease liabilities

(2)

(Note 27)

293

404

-

-

Term loans

(3)

941

1,444

-

-

50,114

53,022

-

400

Non-Current

Finance lease liabilities

(2)

(Note 27)

168

350

-

-

Term loans

(3)

1,618

1,987

-

-

1,786

2,337

-

-

(1)

Short term bank borrowings:

Bank overdrafts of the Group of:

(a) $23,943,000 (2014 : $21,854,000) is secured by mortgage over properties (Note 13), pledged on the

inventories (Note 18) and trade receivables (Note 19) of all subsidiaries of the Company in The Netherlands.