FRENCKEN GROUP LIMITED

ANNUAL REPORT 2015

99

NOTES TO FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2015 (CONT’D)

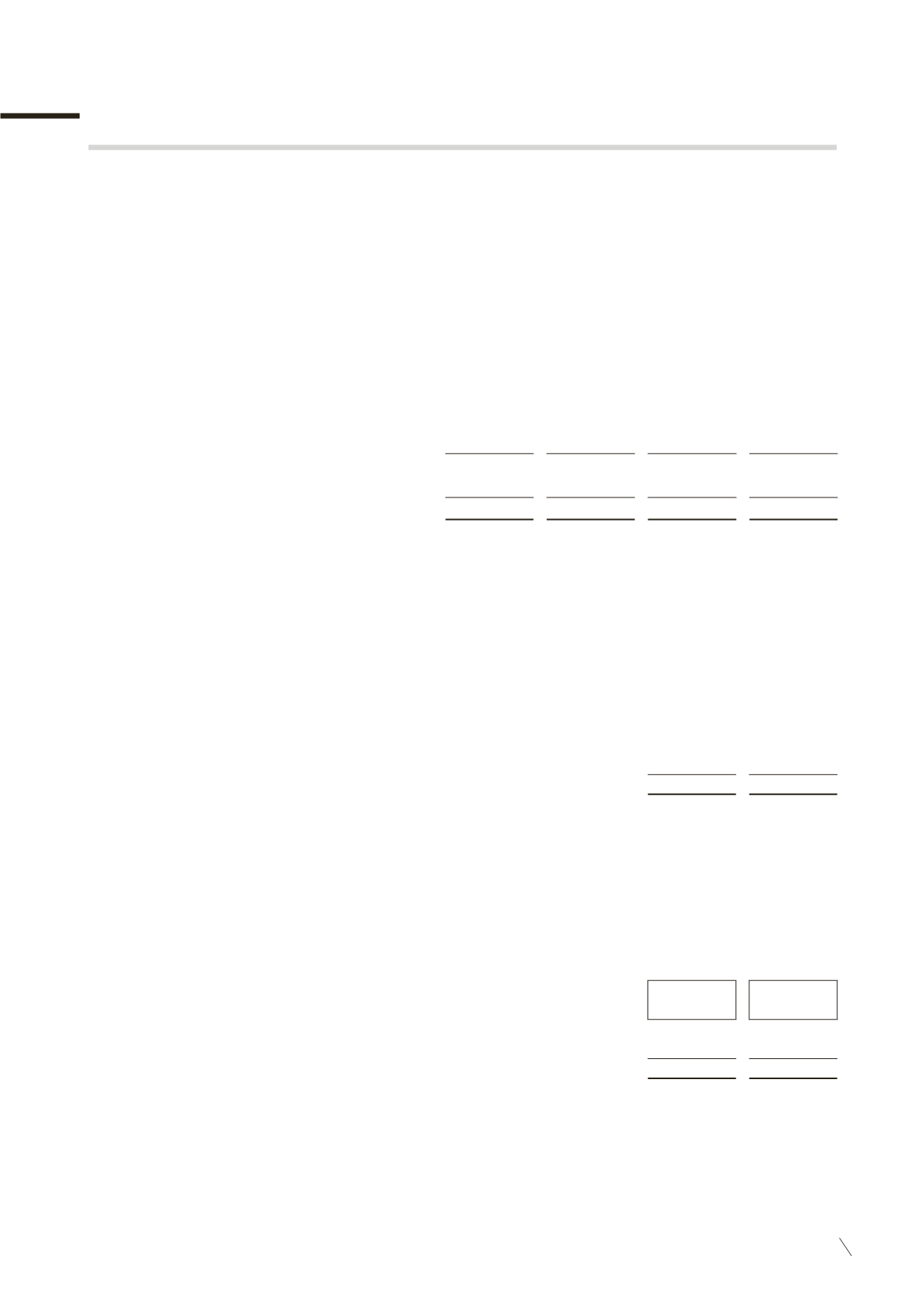

27 FINANCE LEASE LIABILITIES

The future minimum finance lease payments together with their present values are as follows:

The Group

Minimum

payments

2015

$’000

Present

value of

payments

2015

$’000

Minimum

payments

2014

$’000

Present

value of

payments

2014

$’000

Not later than 12 months

296

293

412

404

Between two and five years

169

168

354

350

465

461

766

754

Less: Future finance charges

(4)

-

(12)

-

Present value of finance lease liabilities

461

461

754

754

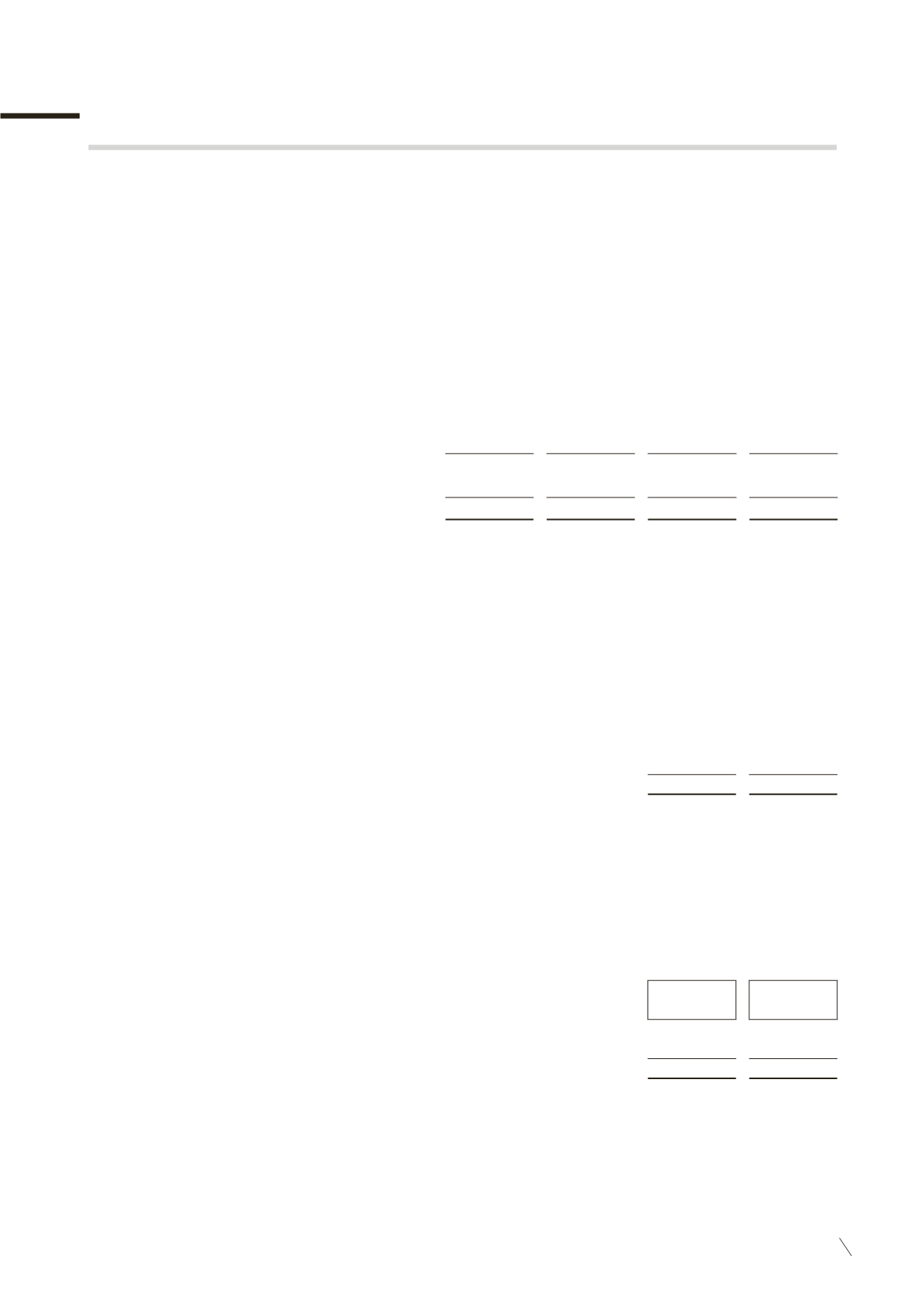

28 DEFERRED INCOME TAX

Deferred income tax assets and liabilities are offset when there is a legally enforceable right to offset current income

tax assets against current income tax liabilities and when the deferred income taxes relate to the same tax authority.

The amounts, determined after appropriate offsetting, are shown on the balance sheet as follows:

The Group

2015

$’000

2014

$’000

Deferred income tax assets

(2,506)

(1,147)

Deferred income tax liabilities

3,600

3,835

1,094

2,688

The movements on the deferred income tax account are as follows:

The Group

2015

$’000

2014

$’000

Balance at beginning of financial year

2,688

2,057

Currency translation differences

(208)

(157)

Charged(Credited) to income statement (Note 10)

- Current year

(1,023)

1,187

- Over recognition in previous financial year

(75)

(41)

(1,098)

1,146

Utilisation

(288)

(358)

Balance at end of financial year

1,094

2,688