FRENCKEN GROUP LIMITED

ANNUAL REPORT 2015

100

NOTES TO FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2015 (CONT’D)

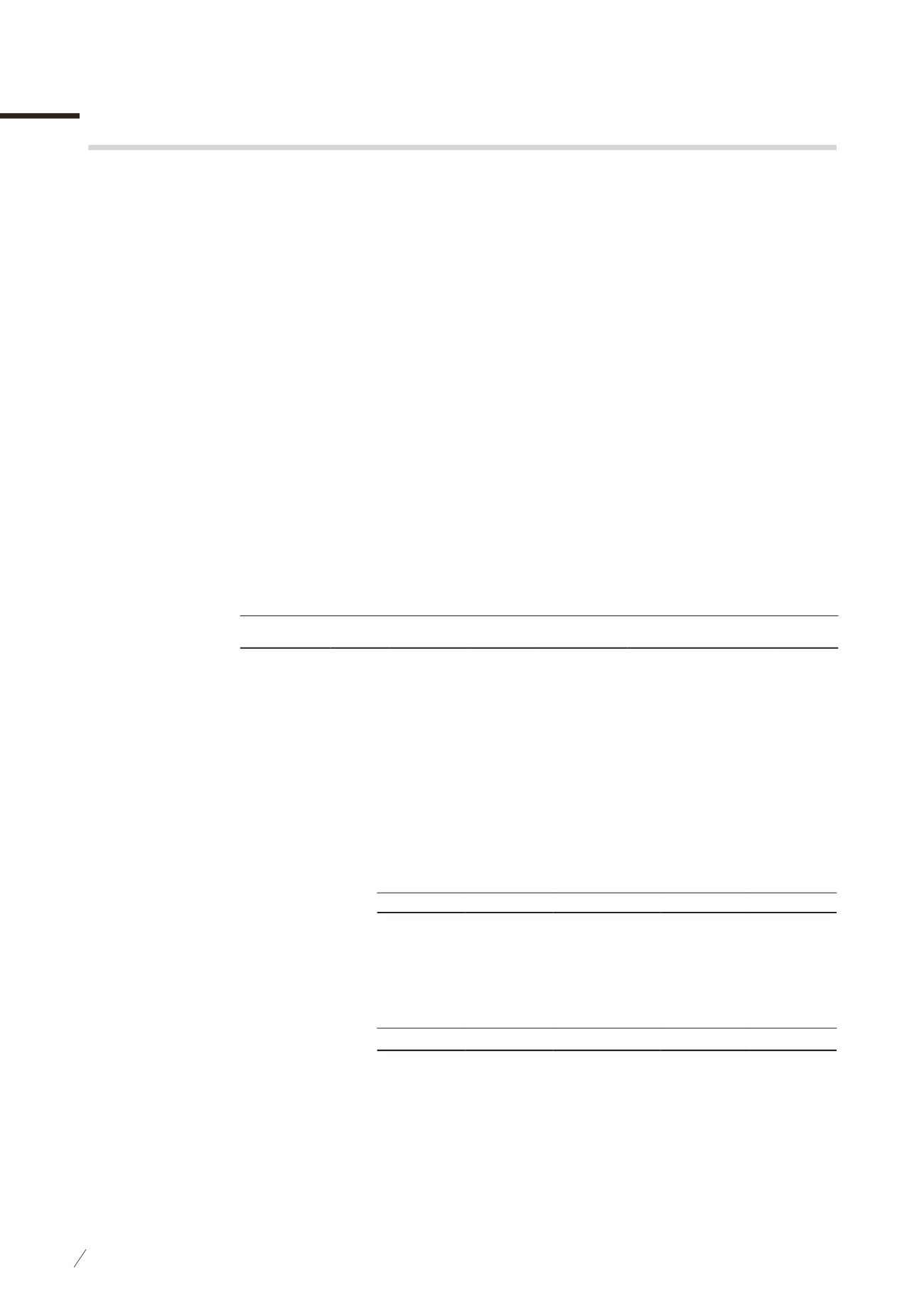

28 DEFERRED INCOME TAX (CONT’D)

The movements in the deferred income tax assets and liabilities (prior to offsetting of balances within the same tax

jurisdiction) during the financial year are as follows:

The Group

Deferred income tax liabilities

2015

2014

Accelerated

tax

depreciation

$’000

Others

$’000

Unremitted

earnings

$’000

Total

$’000

Accelerated

tax

depreciation

$’000

Others

$’000

Unremitted

earnings

$’000

Total

$’000

Balance at beginning

of financial year

1,935 1,807

93 3,835

1,780 1,192

250 3,222

Reclassifications

194 559

210

963

-

-

-

-

Currency translation

differences

(157)

(44)

-

(201)

(42)

(86)

-

(128)

Utilisation

-

(195)

(93)

(288)

-

(170)

(188)

(358)

Charged (Credited) to

income statement

(951)

207

35

(709)

197

871

31 1,099

Balance at end of

financial year

1,021 2,334

245 3,600

1,935 1,807

93 3,835

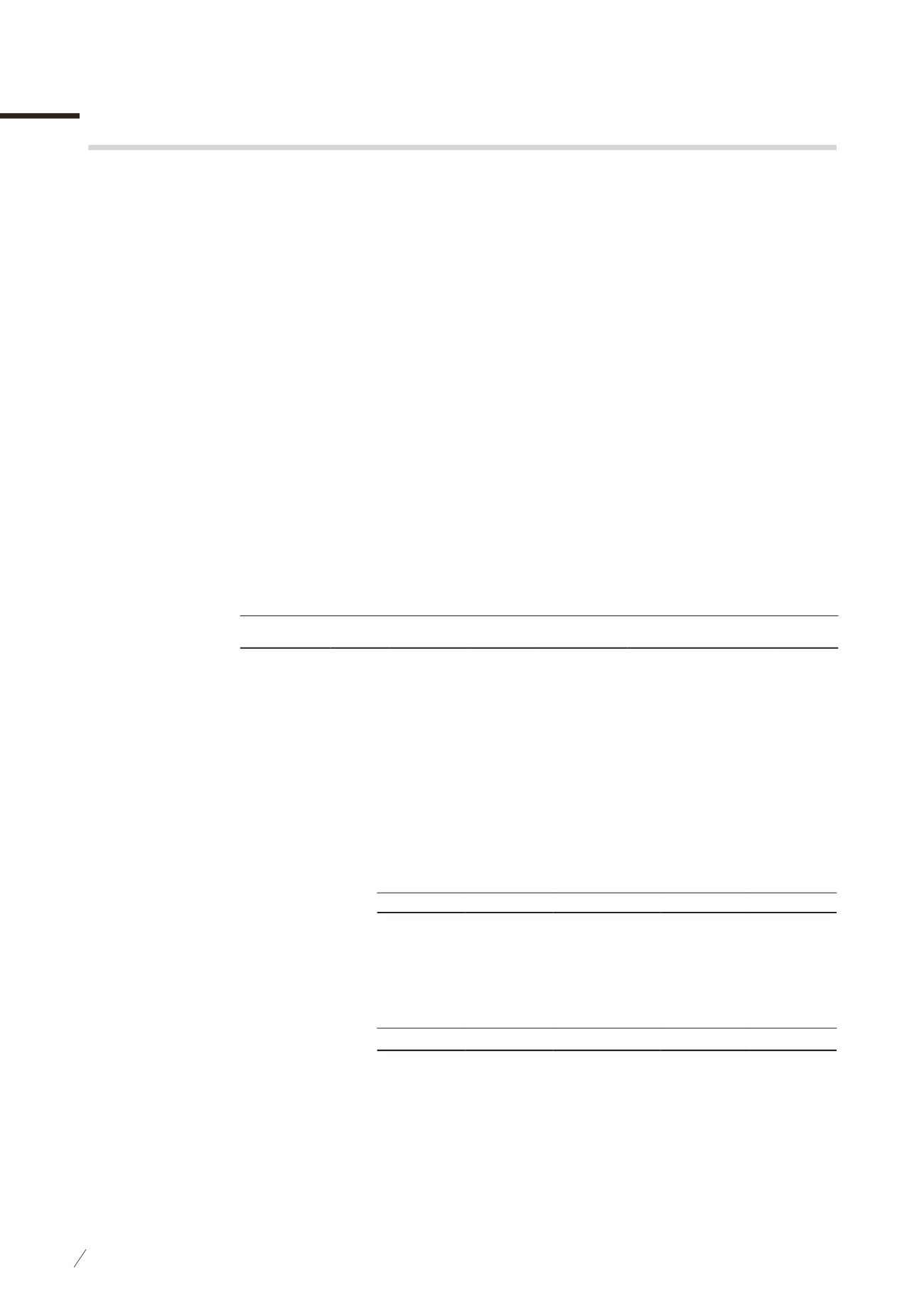

Deferred income tax assets

Unutilised

tax losses

$’000

Accruals

$’000

Reinvestment

allowance

$’000

Capital

allowance

$’000

Total

$’000

2015

Balance at beginning of financial year

(220)

(927)

-

-

(1,147)

Reclassifications

(655)

-

(306)

(2)

(963)

Currency translation differences

8

(15)

-

-

(7)

Charged(Credited) to income

statement

(77)

(426)

112

2

(389)

Balance at end of financial year

(944)

(1,368)

(194)

-

(2,506)

2014

Balance at beginning of financial year

(276)

(889)

-

-

(1,165)

Currency translation differences

(9)

(20)

-

-

(29)

Charged(Credited) to income

statement

65

(18)

-

-

47

Balance at end of financial year

(220)

(927)

-

-

(1,147)

Deferred income tax assets are recognised for unutilised tax losses, unutilised capital allowances and unutilised

reinvestment allowances carried forward to the extent that realisation of the related income tax benefits through

future taxable profits is probable.