FRENCKEN GROUP LIMITED

ANNUAL REPORT 2015

112

NOTES TO FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2015 (CONT’D)

34 FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (CONT’D)

(a) Market risk (Cont’d)

(i) Currency risk (Cont’d)

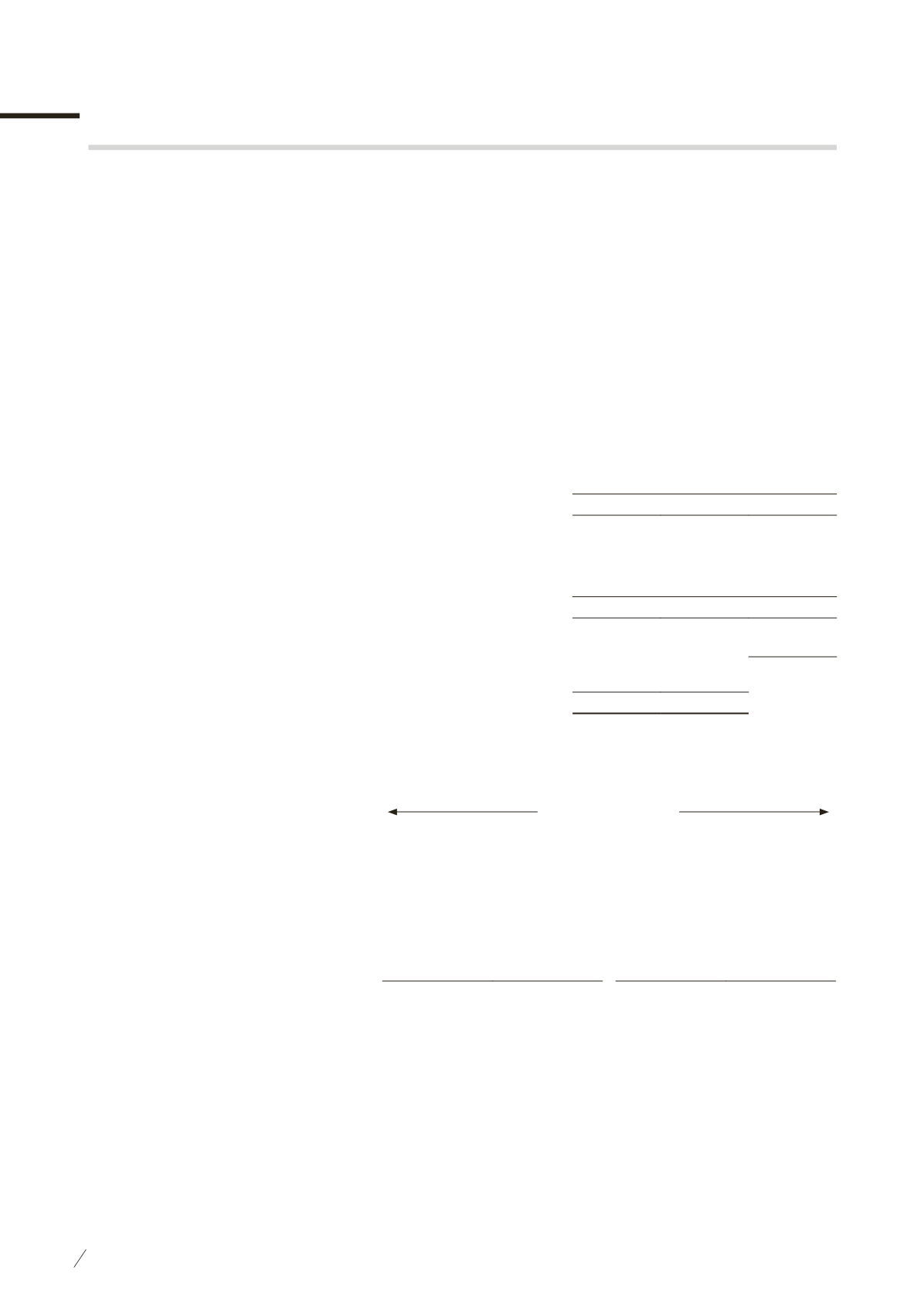

The Company’s currency exposure based on the information provided to key management is as follows:

(Cont’d)

SGD

$’000

Euro

$’000

Total

$’000

31 December 2014

Financial assets

Cash and cash equivalents

2,092

-

2,092

Other receivables

968

361

1,329

Dividend receivables

2,760

1,535

4,295

5,820

1,896

7,716

Financial liabilities

Other financial liabilities

(360)

-

(360)

Borrowings

(400)

-

(400)

(760)

-

(760)

Net financial assets

5,060

1,896

6,956

Less: Net financial assets denominated in the Company’s

functional currency

(5,060)

-

Currency exposure

-

1,896

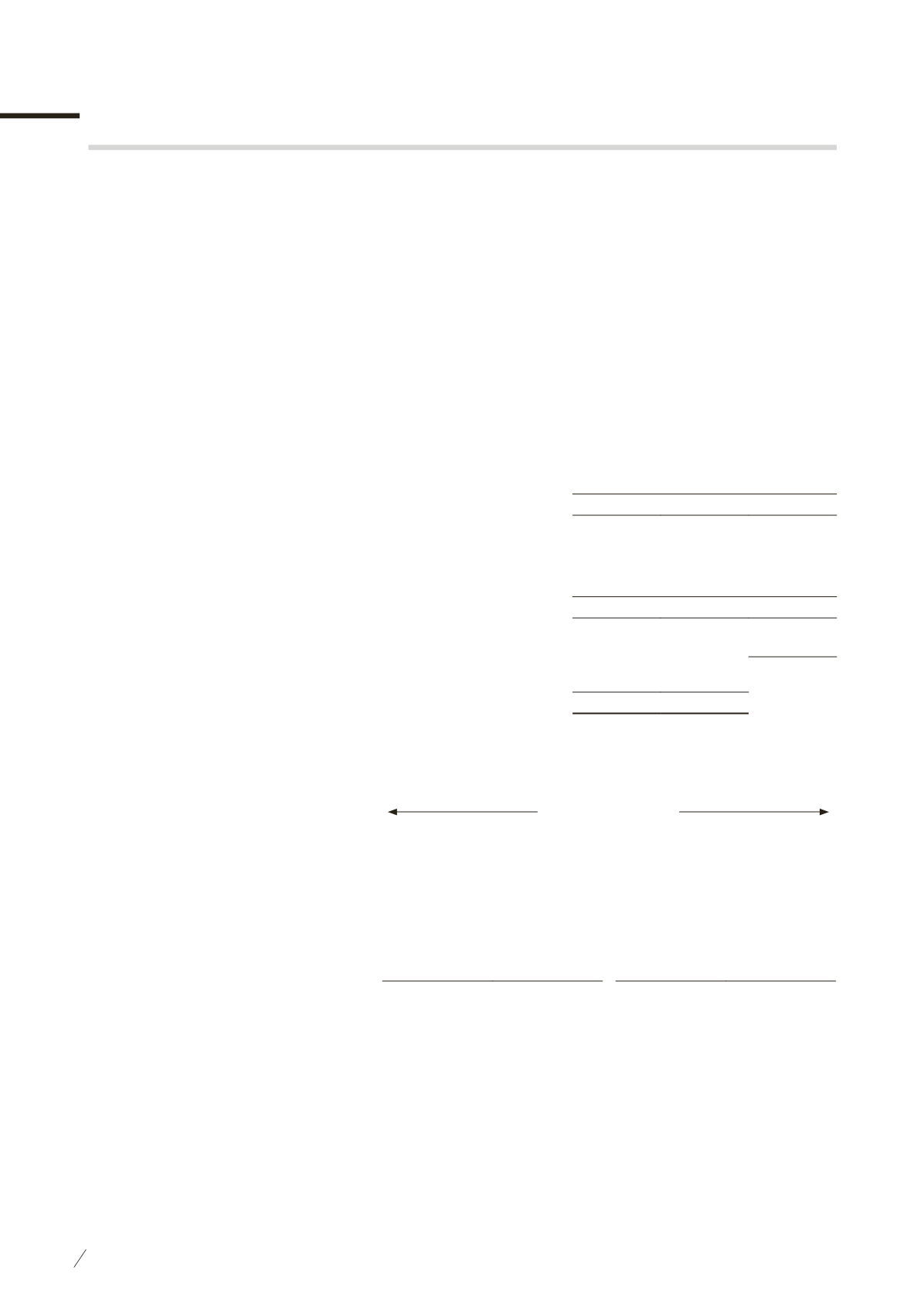

If the Euro changes against the SGD by 6% (2014 : 9%) with all other variables including tax rate being held

constant, the effects arising from the net currency exposure position will be as follows:

2015

2014

Increase/(Decrease)

Profit after

income tax

$’000

Other

component

of equity

$’000

Profit after

income tax

$’000

Other

component

of equity

$’000

Company

Euro against SGD

- strengthened

54

54

142

142

- weakened

(54)

(54)

(142)

(142)

(ii) Price risk

The price risk does not impact the Group as it is not exposed to equity security price risk and commodity price

risk from financial instruments.